Gone are the days when you had to wait in long lines at the bank to cash a check. These days, thanks to the growing digital world, you can cash a check online instantly and get your much-needed cash quickly and effortlessly.

In this guide, we will share some of the best ways to instantly check cash online. We will also share some essential tips on safely depositing a check online, the best apps to cash a check instantly, and much more. So, let’s dive in.

🌟 Top Picks for Online Earnings! 🌟

Dive into our handpicked selection of the best platforms to boost your online income. Trusted by thousands, these platforms are a must-try for anyone looking to make money online.

Turn your opinions into cash with one of the most reputable online survey platforms. Explore Survey Junkie

From watching videos to shopping online, Swagbucks rewards you for everyday online activities. Dive into Swagbucks

Get rewarded for shopping, taking surveys, and more. Check Out Lifepoints

Discover a curated list of remote and flexible jobs. Find Jobs on FlexJobs

Quick and Easy Ways To Cash a Check Online:

Cashing a check could be a big hassle, particularly for those short on time or don’t have easy access to a bank. Luckily, there are now several quick and easy ways to cash checks online instantly, which can save you both time and the stress of waiting in long bank lines.

Here are some of the best online check-cashing services available today when you need your money fast and/or from the comfort of your couch:

Bank Mobile Deposit:

If you’re looking for an easy and cheap way to cash your check remotely, consider a bank mobile deposit.

Thanks to the Check 21 Act (Check Clearing for the 21st Century Act), banks can now accept digital substitute checks that meet legal requirements. This means you can enjoy the convenience of electronic check cashing through remote deposit capture, eliminating the need for physical checks.

The process is fairly straightforward and typically free of charge. You’ll need a smartphone or tablet with a camera. Then, you must take a picture of your check, upload it to your bank’s app, and wait for the money to roll in! It’s that easy!

Mobile check deposits are also the safest and most secure method since the information sent through the app is encrypted to safeguard your personal and financial data.

See Related: Best Side Hustles for Single Moms

Step-By-Step Guide For Bank Mobile Deposit:

The process of using a mobile bank deposit usually involves the following steps:

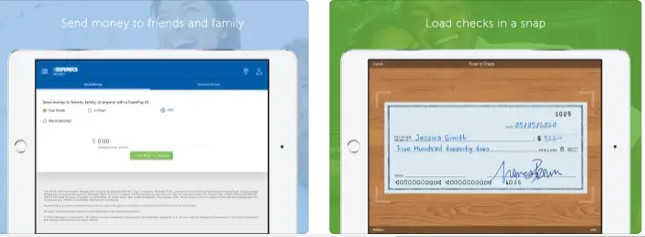

- Open your bank’s mobile app and select the mobile deposit option, such as ‘Cash a Check.’

- Enter the amount of the check and other required details.

- Next, endorse the check by writing “for mobile deposit only” on the back.

- Take a photo of the front and back of the check using your smartphone.

- Confirm the deposit details and submit for approval.

- Wait for the deposit to be processed, which may take one or two business days.

Tips For Bank Mobile Deposit:

There may be additional delays or deposit rejections if:

- the pictures you uploaded were not clear

- the check was not endorsed properly

- the check amount was above the limit allowed by the bank

- technical errors

Furthermore, some banks may place a temporary hold on some or all of your cash. Thus, always check with your bank and credit union to understand their funds’ availability policy and the type of checks they accept.

Generally, banks accept personal, business, and government-issued checks, such as stimulus checks and tax refunds. However, policies regarding third-party checks, money orders, traveler’s checks, or foreign checks may differ. So, checking with your bank or credit union first is best.

Additionally, there may be limits on the amount of the mobile check that can be deposited through mobile check deposit and some fees associated with the special services. For instance, if you choose an express mobile check deposit option, you may need to pay a fee for faster processing.

See Related: Best Apps Where You Can Win Money

A List Of Banks That Offer Bank Mobile Deposit:

- Bank of America

- U.S. Bank

- Ally Bank

- Capital One Bank

- Chase Bank

- Discover Bank

- Citi®

- Wells Fargo

- Truist Bank

- Charles Schwab

- PNC Bank

- HSBC Bank

- TD Bank

Pros and Cons of Bank Mobile Deposit:

| Pros | Cons |

| Convenient and accessible | May have mobile deposit limits |

| Saves time by avoiding trips to the bank or ATM | Risk of errors and hold on funds |

| Super easy to use for low-tech customers | Possible check bouncing can lead to mobile deposit reversal and bank fees |

| Deposit checks directly to your bank account | |

| Safe and Secure |

In a nutshell, bank mobile deposit is a convenient way to deposit checks without visiting a branch. It’s super easy to use and a 100% free option, except for some extra services you might want. If your bank or credit union doesn’t offer bank mobile deposits, consider switching banks.

Online Check-Cashing Apps:

If you don’t have a bank or checking account offering mobile bank deposits, a check-cashing app can be the next best option to cash your check. These third-party mobile applications allow you to cash a check instantly using your smartphone, with or without a fee.

The procedure of electronic check cashing with these apps is similar to that of mobile bank deposits. Just take a photo of the front and back of the check and submit it through the app to receive the funds.

See Related: Ways to Get Free $50 Walmart Gift Cards

Step-By-Step Guide For Online Check-Cashing Apps:

The process typically involves the following steps:

- Download the check-cashing app you like and create a profile.

- Link at least one debit card, credit card, prepaid debit card, or PayPal account to your user profile.

- Tap on the ‘Cash a Check’ option or something similar.

- Take a photo of the front and back of your endorsed check using your smartphone camera.

- Enter the amount of the check and other required details.

- Submit the deposit and wait for approval.

- Once approved, the funds will be available in your account, usually within a few minutes if you pay a fee.

Tips For Online Check-Cashing Apps:

These apps also have hold times on deposits and may charge a fee for quick access to your cash. Some apps may offer their check cashing services for free, while others may charge fees.

Thus, before choosing an app, research to compare check fees and features. Look for an app that offers a good balance of convenience, affordability, and security.

Furthermore, using a check-cashing app may give you various options to access your money. You can load it onto a prepaid debit card or transfer it to your bank account. Alternatively, you can send the funds to a money transfer service like Remitly or MoneyGram for cash pick-up.

However, be aware that there may be fees associated with the express service and limits on the amount of the check that can be cashed. Also, not all checks may be eligible for check cashing apps. So, checking with the app is essential to see if your check is eligible.

Pros and Cons of Check-Cashing Apps:

| Pros | Cons |

| Convenient and accessible | May charge a fee for the service |

| Saves time by avoiding trips to the bank or ATM | May have a week or 10-day hold on funds |

| Super easy to use for low-tech customers | May have mobile check deposit limits |

| Can get your cash within a couple of minutes by paying a fee | May not accept all types of checks |

| Cash check online instantly without bank account |

Check-cashing apps provide a convenient option for instant check-cashing using your smartphone, even without a bank or checking account. However, some apps may charge fees, and not all checks may be eligible.

Best Online Check-Cashing Apps:

Multiple different online check-cashing apps allow you to cash checks. Some of the most popular options include:

1. PayPal:

| Best For | Easy and Secure Check Cashing |

| Rating | 4.8/5 on App Store | 4.2/5 on Google Play Store |

| Deposit Limits | $5,000/day and $15,000/month |

| Processing Time | 10 days with no fee | Within minutes with a fee |

PayPal is a safe and secure online payment platform that allows you to send and receive money. It is also one of the most trusted online payment platforms worldwide.

The app offers a convenient electronic check-cashing feature, “Cash a Check,” that allows you to add cash from checks to your PayPal Balance. All you need to do is take a picture of the front and back of your check, fill in some details (nothing too complicated), and send it to PayPal for review.

With PayPal, you can cash government and payroll checks within minutes with a preprinted signature for a 1% fee. All other accepted checks have a 5% fee. But if you choose the 10-day delayed funding option, there is no fee!

The best part? You can sign up for a personal PayPal account with your name, address, phone number, and email address—no bank account is required.

Pros:

- Convenient and accessible

- Trusted and secure

- Easy to use with a simple interface

- Better fee structure than many other check deposit apps

- Instant online check cashing with a fee

Cons:

- Fees apply for instant check cashing

- Not available to customers in the state of New York

- Not all checks are eligible for deposit

See Related: Ways to Get Free Pizza Gift Cards & Codes

2. Ingo Money App:

| Best For | A wide range of funding options |

| Rating | 4/5 on App Store | 4/5 on Google Play Store |

| Deposit Limits | $5,000/day and $10,000/month |

| Processing Time | 10 days with no fee | Within minutes with a fee |

Ingo Money app is a check-cashing app offered by First Century Bank, N.A., that makes it easy to cash a check, even if you don’t have a bank account. It is one of the most popular apps in the United States for online check cashing services, with amazing offers and many features.

To use the Ingo Money app, you’ll need to link at least one debit card, credit card, prepaid card, or PayPal account to your account. Once you’ve done that, you can easily deposit any of your checks (except those that Ingo Money does not accept).

To deposit a check, sign in and tap ‘Cash a Check. ‘ Take photos of your check, fill in some simple details, and submit your check for review. Usually, it only takes 3 to 5 minutes for Ingo Money to approve your check. But in some circumstances, it could also take up to an hour.

Remember that there is a flat $5 fee for payroll or government checks amounting to $250 or less (2% for checks over $250). All other accepted checks amounting to $100 or less have a flat $5 fee (5% for checks over $100). But if you choose the 10-day delayed funding option, there is no fee!

And the best part? If you cash checks frequently, you might qualify for Ingo Money Gold Preferred Pricing! That is, you will get discounted rates if you’ve cashed at least six checks in the last 90 days

Pros:

- Convenient and accessible

- Versatile

- Instant check cashing and deposit options

- Quick and easy process

- No bank account is needed for check cashing

- Preferred pricing for frequent users

- Split check option

Cons:

- Higher fee structure for instant check cashing compared to some other option

- Not available for use within the state of New York

- Not all checks are eligible for deposit

See Related: How to Start a Side Hustle

3. NetSpend:

| Best For | Discount offers on FDA-approved prescriptions |

| Rating | 3.1/5 on App Store | 4/5 on Google Play Store |

| Deposit Limits | $5,000/day and $10,000/month |

| Processing Time | 10 days with no fee | Within minutes with a fee |

NetSpend is provided through Ingo Money, so its online check cashing service is the same as the Ingo Money app. The standard fee structure and steps for depositing a check are similar.

Like the Ingo Money app, you can also get a fast direct deposit with NetSpend. There is a minimum $5 or 2% fee for payroll or government checks, and all other accepted checks have a minimum $5 or 5% fee. But if you choose the 10-day delayed funding option, there is no fee!

One thing that sets Netspend apart is that they offer a Pharmacy Savings Card that can provide discounts of up to 50% on FDA-approved pharmaceuticals. This means you can save on prescription purchases with the Pharmacy Savings Card.

Pros:

- Convenient and accessible

- Easy to use with a simple interface

- Get paid up to 2 days faster with direct deposit

- Instant check cashing and deposit options

- Discount offers available on FDA-approved prescriptions

Cons:

- Fees may apply

- It may not be suitable for larger checks, as it has a limit of $2,500 per check

- Not all checks are eligible for deposit

See Related: Best Part-Time Businesses to Start in 2023 & Make Money

4. Brink’s Money Prepaid Mobile App:

| Best For | Fast payments via direct deposit |

| Rating | 3.3/5 on App Store | 4.1/5 on Google Play Store |

| Deposit Limits | $5,000/day and $10,000/month |

| Processing Time | 10 days with no fee | Between 3 to 5 minutes with a fee |

Brink’s, a trusted armored transportation company, now offers a prepaid Mastercard debit card and check cashing service through their mobile app. For over a century, they have provided secure transportation of valuables such as cash. So, you can trust them with their check cashing service as well.

With Brink’s Money app, you can easily deposit a check to your reloadable prepaid card. The steps for depositing a check on Brink’s Money app are somewhat similar to the above apps— fairly simple and easy to follow. Reviewing and approving a check typically takes 3 to 5 minutes, although it may take up to an hour in some instances.

Furthermore, you can also schedule direct deposits from your employer or transfer money from another Brink’s prepaid debit card or bank account. The best part is that you can even earn amazing cash back with Brinks Money Prepaid Points!

Brink’s check cashing service is offered through First Century Bank, N.A. & Ingo Money, Inc., and comes with a small fee. There’s a 2% expedited fee for government and payroll checks and a 5% expedited fee for all other checks. But if you choose the 10-day delayed funding option, there is no fee.

Pros:

- Convenient and accessible

- Easy to use with a simple interface

- Allows users to deposit checks directly to their prepaid cards

- Instant online check cashing with a fee

Cons:

- It may not be suitable for larger checks, as it has a limit of $2,500 per check

- Not all checks are eligible for deposit

- Some users have reported issues with customer service

See Related: Builderall Review: Is It Worth the Price?

A Comparison Table of Various Online Check Cashing Apps and Services:

In the table below, we have compared various online check-cashing apps and services side by side to help you make an informed decision:

| Mobile App /Service | Processing Time | Fees | Additional Features |

| Mobile Bank Deposit | 1–5 business days with no fee | Free | ✔Fast direct deposits, safe and secure, ✔Easy to use, ✔Some major banks may allow deposit checks up to $50,000 per month |

| PayPal | 10 days with no fee | Within minutes with a fee | 1% to 5% of check value | ✔Near-instant funding to PayPal Balance account with a fee, ✔No bank account required, -Better fee structure, ✔Funds can be transferred to a bank account or used for online purchases |

| Ingo Money | 10 days with no fee | Within minutes with a fee | Minimum $5 fee or 2% to 5% of check value | ✔Instant online check cashing with a fee, ✔A wide range of funding options, ✔Funds can be transferred to a bank account or used for online purchases, ✔Offers discounted rates to frequent users, |

| NetSpend | 10 days with no fee | Within minutes with a fee | Minimum $5 fee or 2% to 5% of check value | ✔Express processing with a fee, ✔Can get paid up to 2 days faster with direct deposit, ✔Funds can be loaded onto a prepaid card, ✔Up to 50% discount on FDA-approved prescriptions |

| Brink’s Money Prepaid | 10 days with no fee | Within minutes with a fee | 2% to 5% of check value | ✔Allows users to deposit checks directly to their prepaid card, ✔Can earn cash back with Brinks Money Prepaid Points, ✔Instant online check cashing with a fee |

FAQs:

How Can I Cash a Check Online Instantly?

To cash a check online instantly, you can use any of the apps mentioned above (PayPal, Ingo Money app, etc.). These apps allow you to deposit the check using your smartphone, and the funds are typically available within minutes. Remember that most mobile apps charge a fee for any expedited service.

What Apps or Services Offer Instant Online Check Cashing?

Almost all the check-cashing apps mentioned above offer instant check-cashing with a fee. However, depending on the type of check, you may have to pay a 1%–5% fee.

Are There Any Fees Associated With Online Check Cashing?

Well, the answer is both yes and no. There is no fee associated with the standard online check cashing procedure. However, most, if not all, online check cashing services offer expedited service that processes the check within a couple of minutes or hours.

Is Depositing a Check Online Secure?

Yes, depositing a check online is secure, simple, convenient, and fast. However, scammers are always actively discovering new methods to bypass security measures. Therefore, it’s always advisable to follow security measures such as using a secured Wi-Fi connection, not using unverified or untrusted apps, and setting up multi-factor authentication.

How Quickly Will Funds Become Available After Cashing a Check Online?

You can get funds into your account within a few minutes by paying a fee for expedited service.

Can I Cash a Check Online Without A Bank Account?

Yes, you can. Mobile apps like PayPal and Ingo Money offer check-cashing services without a bank account.

Are There Any Restrictions On The Types Of Checks I Can Deposit Online?

Yes. Most banks and third-party check deposit apps only accept pre-printed checks, payroll checks, government-issued checks, cashier’s checks, two-party personal checks, and 401(k) disbursement checks. However, policies regarding third-party checks, money orders, traveler’s checks, or foreign checks may differ. So, first, checking with your bank, credit union, or app service is best.

What Should I Do With The Physical Check After Depositing It Online?

Hold your physical check even after depositing it through your bank’s mobile app or any other check-cashing app. This can help you avoid online deposit errors or glitches in the mobile banking app.

Related Resources: